Mosaic Brands voluntary administration marked a significant event in Australian retail. The company’s downfall wasn’t sudden; rather, it was a culmination of factors including mounting debt, shifting consumer preferences, and the challenging economic climate. This analysis delves into the key financial indicators leading to the administration, the legal processes involved, the impact on various stakeholders, potential restructuring strategies, and crucial lessons learned for the future of the retail industry.

Understanding the circumstances surrounding Mosaic Brands’ financial difficulties requires a close examination of its debt structure, operational inefficiencies, and the broader economic context. Analyzing the timeline of events leading to voluntary administration reveals critical junctures where different strategic decisions could have altered the company’s trajectory. Furthermore, the case study provides valuable insights into the complexities of navigating voluntary administration, creditor negotiations, and potential outcomes, offering valuable lessons for both businesses and investors.

Mosaic Brands’ Financial Situation Leading to Voluntary Administration

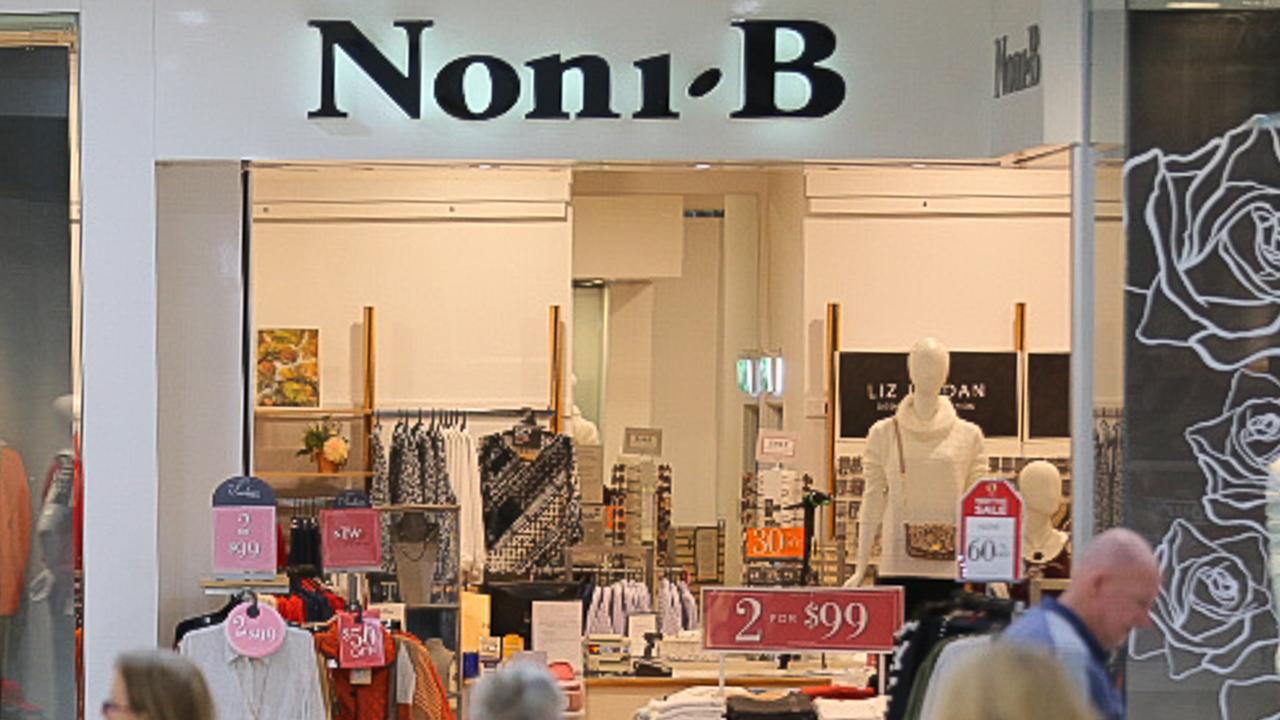

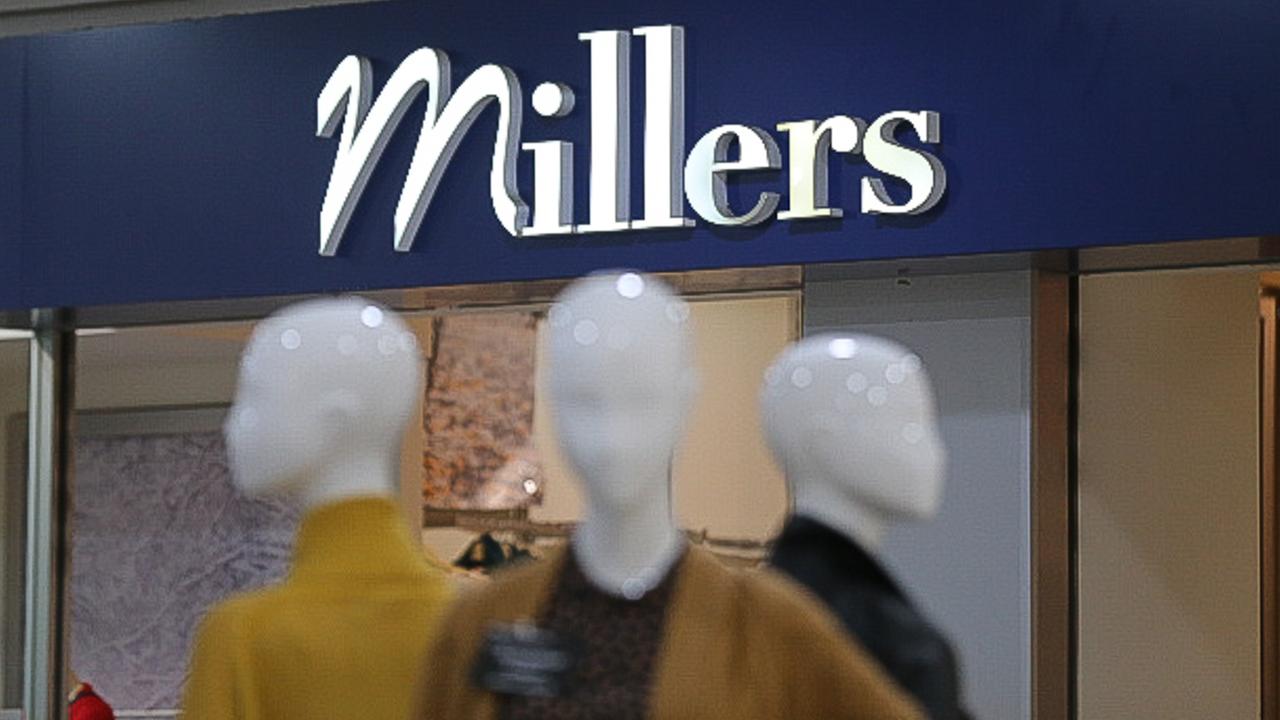

Mosaic Brands’ entry into voluntary administration in 2020 was the culmination of several years of declining financial performance, compounded by significant debt and the impact of external factors. The company, which operated a portfolio of well-known Australian clothing brands, ultimately faced unsustainable levels of debt and dwindling sales, forcing it to seek protection from creditors.

Several key financial indicators pointed towards the company’s impending financial distress. These included consistently declining revenue, shrinking profit margins, and a rising debt-to-equity ratio. The company’s inability to adapt to changing consumer preferences and the increasingly competitive retail landscape further exacerbated its financial woes. A deteriorating cash flow position severely hampered its ability to meet its operational and financial obligations, ultimately leading to the decision to enter voluntary administration.

Recent news regarding Mosaic Brands’ financial difficulties has understandably caused concern among stakeholders. Understanding the complexities of this situation requires careful consideration, and a helpful resource for gaining further insight is available at mosaic brands voluntary administration. This website offers valuable information to help navigate the implications of Mosaic Brands’ voluntary administration and its potential impact on the future of the company.

Mosaic Brands’ Debt Structure and Operational Capacity

Mosaic Brands carried a substantial debt load, significantly impacting its operational capacity. This debt was a mix of secured and unsecured borrowings, including bank loans and bonds. The high level of debt resulted in significant interest payments, consuming a considerable portion of the company’s cash flow that could have been invested in essential operational improvements, marketing initiatives, or inventory management.

The pressure to service this debt restricted the company’s flexibility to respond effectively to changing market conditions and invest in growth opportunities. The weight of this debt significantly reduced its ability to invest in modernization, marketing, or new product development, ultimately hindering its competitiveness.

External Factors Contributing to Financial Difficulties

Several external factors contributed significantly to Mosaic Brands’ financial struggles. The Australian retail sector experienced a period of significant disruption in the years leading up to the voluntary administration. A challenging economic climate, marked by slow economic growth and reduced consumer spending, impacted sales across the retail sector. The rise of online shopping and the increasing popularity of fast fashion also presented significant challenges to traditional brick-and-mortar retailers like Mosaic Brands.

These external pressures, coupled with the company’s internal challenges, created a perfect storm that ultimately led to its financial difficulties.

Timeline of Significant Financial Events

A timeline of significant financial events leading up to the voluntary administration would include:

- [Year]: [Specific financial event, e.g., Significant decline in sales revenue reported]. Provide a concise description of the event and its impact.

- [Year]: [Specific financial event, e.g., Announcement of restructuring plans to reduce costs]. Provide a concise description of the event and its impact.

- [Year]: [Specific financial event, e.g., Further decline in profitability and increased debt]. Provide a concise description of the event and its impact.

- [Year]: [Specific financial event, e.g., Appointment of administrators]. Provide a concise description of the event and its impact.

Note: Specific dates and details would need to be researched from reliable financial news sources and Mosaic Brands’ financial reports. This section provides a template for the required information.

The Voluntary Administration Process for Mosaic Brands: Mosaic Brands Voluntary Administration

Mosaic Brands’ entry into voluntary administration triggered a formal legal process designed to restructure the company and potentially save it from liquidation. This process, governed by Australian law, involves several key stages and participants with specific roles and responsibilities.The legal procedures involved in the voluntary administration process in Australia are Artikeld in the Corporations Act 2001. The process begins with the appointment of an administrator, typically a qualified insolvency practitioner, by the company’s directors.

This appointment is intended to provide a breathing space, shielding the company from creditor action while a plan for its future is developed. The administrator then takes control of the company’s assets and operations, undertaking a comprehensive review of its financial position and exploring all viable options for its future.

Roles and Responsibilities of the Administrators

The administrators appointed to Mosaic Brands had several crucial responsibilities. These included investigating the company’s financial affairs, maximizing the chances of the company continuing its business as a going concern, preparing a report to creditors outlining the company’s financial situation and various options available, and overseeing negotiations with creditors. They also had a duty to act in the best interests of the company’s creditors as a whole, balancing the competing interests of secured and unsecured creditors.

This required a delicate balance of negotiation and strategic decision-making.

Creditor Negotiations and Potential Outcomes

A significant part of the voluntary administration process involves negotiations with creditors. The administrators must communicate with creditors, providing them with regular updates on the company’s financial situation and proposed restructuring plans. Negotiations can involve proposing a Deed of Company Arrangement (DOCA), a legally binding agreement that Artikels how the company’s debts will be repaid. The outcome of these negotiations can vary.

A successful DOCA allows the company to continue operating under a restructured financial framework. However, if a suitable DOCA cannot be agreed upon, the administrators may recommend liquidation, resulting in the company’s assets being sold to repay creditors. Other possible outcomes include a sale of the business as a going concern to a third party.

Examples of Similar Cases in the Retail Sector

Several other retail companies have undergone voluntary administration in Australia. The outcomes have varied depending on the circumstances of each case. The following table provides examples:

| Company Name | Industry | Date of Administration | Outcome |

|---|---|---|---|

| (Example 1: Replace with actual company name) | (Example: Apparel Retail) | (Example: MM/YYYY) | (Example: Successful DOCA, Restructuring) |

| (Example 2: Replace with actual company name) | (Example: Department Stores) | (Example: MM/YYYY) | (Example: Liquidation) |

| (Example 3: Replace with actual company name) | (Example: Specialty Retail) | (Example: MM/YYYY) | (Example: Sale of Business as a Going Concern) |

| (Example 4: Replace with actual company name) | (Example: Discount Retail) | (Example: MM/YYYY) | (Example: Failed DOCA, Liquidation) |

Impact on Stakeholders

The voluntary administration of Mosaic Brands has far-reaching consequences for a variety of stakeholders, impacting their financial stability, employment prospects, and overall business operations. Understanding these impacts is crucial for assessing the broader implications of this significant event in the Australian retail sector. The following sections detail the effects on key stakeholder groups.

Impact on Employees, Mosaic brands voluntary administration

Mosaic Brands’ voluntary administration directly affects its employees, creating uncertainty regarding job security and future employment. Redundancies are a likely outcome as the company undergoes restructuring. The severity of job losses will depend on the outcome of the administration process, with potential scenarios ranging from minimal job losses through to significant workforce reductions across various roles and locations.

Support packages for affected employees, including outplacement services and redundancy payments, will be crucial in mitigating the negative consequences. The level of support provided will depend on the administrator’s assessment of the company’s financial resources and the terms negotiated with employees and their representatives.

Impact on Suppliers and Other Business Partners

Suppliers to Mosaic Brands face potential financial losses due to outstanding invoices and delayed payments. The administration process may result in the cancellation of existing contracts, leaving suppliers with unsold inventory and potential write-offs. Business partners, such as franchisees and marketing agencies, also experience uncertainty, facing potential disruptions to their operations and revenue streams. The ability of Mosaic Brands to honor existing contractual obligations will depend on the success of the restructuring process and the availability of funds to settle outstanding debts.

Prioritization of payments to critical suppliers might occur, leaving some with less immediate access to funds.

Impact on Shareholders and Investors

Shareholders and investors face significant losses as the value of their Mosaic Brands shares is likely to decline substantially. The company’s equity value is expected to be significantly impaired during the administration process, and there is a risk that shareholders may recover little or nothing from their investment. The extent of the losses will depend on the outcome of the administration, including the potential sale of assets and the recovery of debts.

This situation highlights the inherent risks associated with investing in companies operating in volatile sectors such as retail. Similar situations have been seen with other retailers facing financial distress, where shareholder value has been significantly diminished.

Impact on Consumers and the Retail Landscape

Consumers may face disruptions in accessing Mosaic Brands’ products and services. Store closures are a possibility during the administration process, limiting consumer choice and potentially affecting the availability of certain brands. The long-term impact on the retail landscape depends on the outcome of the administration. If Mosaic Brands is successfully restructured, it might continue to operate, albeit potentially with a reduced footprint and product range.

However, liquidation is also a possibility, which would remove a significant player from the market and potentially lead to job losses and reduced competition. The impact on consumer confidence could also be significant, especially if consumers are left with outstanding orders or unresolved customer service issues.

Potential Outcomes and Restructuring Strategies

Mosaic Brands’ voluntary administration presents several potential outcomes, each with varying implications for the company’s future and its stakeholders. The success of any restructuring strategy hinges on a careful assessment of the company’s assets, liabilities, and market position, coupled with a pragmatic approach to debt reduction and operational efficiency improvements. The following explores potential restructuring scenarios and their long-term effects.

Restructuring Scenarios for Mosaic Brands

Several restructuring scenarios are possible for Mosaic Brands following its voluntary administration. These scenarios range from a complete sale of the business to a more comprehensive reorganization focused on operational efficiency and debt reduction. The choice will depend on the outcome of the administration process and the proposals put forward by the administrators.

Strategies for Debt Reduction and Operational Efficiency

Effective restructuring requires a multifaceted approach to both debt reduction and operational efficiency improvements. Debt reduction strategies could involve negotiating with creditors to reduce the principal amount owed, extending repayment terms, or exploring options such as debt-for-equity swaps. Simultaneously, improving operational efficiency might involve streamlining supply chains, reducing overhead costs through workforce adjustments or technology implementation, and optimizing inventory management to minimize waste and holding costs.

For example, a successful strategy might involve closing underperforming stores and focusing on online sales channels, as seen with other retailers adapting to changing consumer behaviour.

Recent news regarding Mosaic Brands has understandably caused concern among stakeholders. Understanding the complexities of this situation requires careful consideration of the circumstances leading to the mosaic brands voluntary administration. This process, while challenging, aims to facilitate a restructuring that could ultimately safeguard the future of the company and its employees.

Comparison of Restructuring Options

Three primary restructuring options exist: sale, liquidation, and reorganization. A sale involves finding a buyer for the entire business or parts of it, potentially preserving some jobs and brand value. Liquidation, on the other hand, involves selling off assets to repay creditors, often resulting in job losses and the complete cessation of operations. Reorganization focuses on restructuring the company’s debt and operations to improve its long-term viability.

This might involve closing unprofitable stores, renegotiating leases, and implementing cost-cutting measures. The choice between these options depends on factors such as the availability of buyers, the value of the company’s assets, and the likelihood of successful reorganization. For instance, a company with strong brand recognition but high debt might opt for a sale to a competitor, while a company with significant debt and declining sales might face liquidation.

Long-Term Effects of Restructuring Strategies

The long-term viability of Mosaic Brands will significantly depend on the chosen restructuring strategy. A successful sale could provide a fresh start under new ownership, potentially leading to renewed growth and profitability. Liquidation, however, results in the permanent closure of the business, leading to job losses and the loss of brand equity. Reorganization, if successful, can lead to a leaner, more efficient company, but it requires significant effort and may still result in job losses in the short term.

The long-term effect will depend on the success of the implemented cost-cutting and efficiency improvements, as well as the company’s ability to adapt to changing market conditions. For example, successful reorganization could lead to a more sustainable business model focused on e-commerce and a smaller, more efficient store footprint, mirroring the strategies adopted by many successful retailers.

Lessons Learned and Future Implications

Mosaic Brands’ voluntary administration offers valuable insights into the challenges facing the retail sector, highlighting the importance of adaptable business models and robust financial planning. Analyzing the company’s downfall provides crucial lessons for other retailers, emphasizing the need for proactive strategies to mitigate similar risks.The experience underscores the critical need for a diversified revenue stream, effective inventory management, and a keen understanding of evolving consumer preferences.

Failure to adapt to changing market dynamics, coupled with an over-reliance on physical retail spaces in a rapidly digitalizing environment, significantly contributed to Mosaic Brands’ financial distress. The lessons learned extend beyond immediate financial strategies, encompassing broader operational efficiency and a proactive approach to risk management.

Key Lessons Learned from Mosaic Brands’ Voluntary Administration

Mosaic Brands’ case study reveals several critical weaknesses that led to its financial difficulties. These include an over-reliance on brick-and-mortar stores without a strong enough online presence, inadequate inventory management leading to stock write-downs, and a failure to adapt quickly enough to changing consumer spending habits. The company’s debt burden also played a significant role, limiting its ability to invest in necessary upgrades and expansion.

Furthermore, the lack of diversification across brands and product lines left the company vulnerable to shifts in market demand.

Implications for Other Businesses in the Retail Sector

The implications for other retailers are significant. The case highlights the vulnerability of businesses heavily reliant on traditional retail models in a rapidly evolving digital landscape. Companies need to prioritize the development of robust e-commerce platforms and integrate omnichannel strategies to reach a broader customer base. Effective inventory management, predictive analytics, and agile supply chains are crucial to mitigate risks associated with fluctuating demand and changing consumer preferences.

Furthermore, a prudent approach to debt management and financial planning is essential to ensure long-term sustainability.

Preventing Similar Situations in the Future

Preventing similar situations requires a multi-pronged approach. Retailers must prioritize data-driven decision-making, leveraging analytics to understand consumer behavior and optimize inventory management. This includes investing in advanced forecasting models to predict demand accurately and avoid overstocking or stockouts. Diversification of product lines and sales channels, including a strong online presence, is crucial to mitigate risks associated with market fluctuations.

Regular financial health checks, including stress testing scenarios, are essential to identify potential vulnerabilities and develop proactive mitigation strategies. Finally, fostering a culture of agility and adaptability is vital to respond effectively to changing market conditions and consumer demands.

Factors Contributing to Mosaic Brands’ Financial Distress

A visual representation of the contributing factors could be depicted as a branching diagram. At the center, place “Mosaic Brands’ Financial Distress.” Branching out from the center would be three main branches: “Inadequate Digital Strategy” (leading to smaller branches like “Weak e-commerce platform,” “Lack of omnichannel integration”), “Poor Inventory Management” (with branches like “Overstocking,” “Inefficient supply chain”), and “High Debt Burden and Limited Financial Flexibility” (with branches like “High levels of debt,” “Limited investment capacity”).

Each smaller branch could further illustrate specific contributing factors. This illustration would clearly show the interconnectedness of these factors in leading to the company’s financial crisis.

The Mosaic Brands voluntary administration serves as a stark reminder of the vulnerabilities inherent in the retail sector. While the ultimate outcome remains to be seen, the case study highlights the importance of proactive financial management, adaptability to changing consumer trends, and the need for robust restructuring strategies to navigate economic downturns. The lessons learned from this experience can inform future business practices and contribute to a more resilient and adaptable retail landscape.

The analysis presented here provides a comprehensive overview of the situation, offering valuable insights for businesses, investors, and stakeholders alike.

Helpful Answers

What were the immediate consequences of Mosaic Brands entering voluntary administration for its employees?

Immediate consequences for employees often include uncertainty regarding job security and potential redundancies. The administrators will assess the viability of the business and determine the workforce required moving forward.

What are the potential long-term implications for the Australian retail landscape?

The long-term implications could include increased scrutiny of retail business models, a potential shift in consumer spending habits, and a greater emphasis on sustainable and adaptable business practices. It may also influence future government policies related to retail and business support.

How does the Australian voluntary administration process differ from processes in other countries?

The specifics of voluntary administration vary by jurisdiction. While the core aim—to provide a framework for restructuring or liquidation—remains consistent, the legal procedures, timelines, and creditor rights might differ significantly between countries. Legal expertise specific to the relevant jurisdiction is crucial.